Principles of Macro Economics-1 PYQ 2022

Read paper here or download the pdf file and share it with your mates

Q1. What is business cycle? How does the unemployment rate behave over the course of business cycle? Explain.

Ans. The business cycle refers to the recurrent fluctuations in economic activity that occur over time. It is characterized by alternating periods of expansion and contraction in an economy’s production and employment levels. The business cycle is typically divided into four phases: expansion, peak, contraction, and trough.

During the expansion phase, economic activity increases, leading to higher levels of output, income, and employment. The peak is the point at which economic activity reaches its highest level before beginning to slow down. The contraction phase follows the peak and is characterized by declining economic activity, lower output, and decreased employment. The trough is the point at which economic activity reaches its lowest level before starting to recover.

The behavior of the unemployment rate is closely linked to the business cycle. As the economy goes through these phases, the unemployment rate tends to follow a specific pattern:

Expansion Phase:

During the expansion phase, economic growth is strong, businesses are expanding, and demand for labor increases. As a result, more jobs are created, and the unemployment rate tends to decrease.

People who were previously unemployed often find opportunities in this phase.

Peak Phase:

As the economy reaches its peak, the pace of job creation starts to slow down. While there may still be job openings, they might not be as abundant as during the expansion phase. The unemployment rate might remain relatively low but could start stabilizing or inching upward slightly.

Contraction Phase:

During the contraction phase, economic activity slows down, businesses might cut back on production, and demand for labor decreases. This leads to a rise in unemployment as companies may lay off workers or reduce hiring. The unemployment rate tends to increase significantly during this phase.

Trough Phase:

At the trough, the economy hits its lowest point in terms of output and employment. The unemployment rate is usually at its highest during this phase, as many individuals are either out of work or working part-time involuntarily. There’s a general sense of economic distress and uncertainty.

The relationship between the unemployment rate and the business cycle reflects the inherent dynamics of an economy. During periods of economic expansion, job opportunities are abundant, leading to lower unemployment rates. Conversely, during economic contractions, jobs become scarcer, causing the unemployment rate to rise.

It’s important to note that the behavior of the unemployment rate can be influenced by various factors, including government policies, technological advancements, and global economic conditions. Economic policymakers often work to mitigate the impact of business cycles on unemployment by implementing measures like monetary and fiscal policies to stimulate economic growth during contractions and control inflation during expansions.

Q2. Prove that :-

Spvt + Sgovt – CA = I (Where; Spvt, Sovt, CA, and I are Private saving, Government saving, Current account and investment respectively)

Explain the economic interpretation of this identity.

Ans. The identity here provided, Spvt + Sgovt – CA = I, represents the National Income Identity, which is a fundamental concept in macroeconomics. Let’s break down the identity and prove it step by step:

Spvt (Private Saving): This refers to the portion of income that households save after consuming. It’s calculated as the difference between disposable income (YD) and consumption expenditure (C): Spvt = YD – C.

Sgovt (Government Saving): This represents the difference between government revenue (T) and government expenditure (G): Sgovt = T – G.

CA (Current Account): The current account is the balance of trade between a country and the rest of the world. It includes the trade balance (exports minus imports), net income from abroad, and net transfers. CA can be either positive (surplus) or negative (deficit), depending on whether a country is exporting more than it’s importing.

I (Investment): Investment refers to the spending on capital goods that will be used to produce goods and services in the future. It includes expenditures on machinery, equipment, buildings, and infrastructure.

Now, let’s substitute the definitions of Spvt, Sgovt, and CA into the identity and prove it:

Spvt + Sgovt – CA = I

(YD – C) + (T – G) – CA = I

(Y – T – C) + (T – G) – CA = I

Y – T – C + T – G – CA = I

Y – C – G – CA = I

The identity is proved.

Economic Interpretation:

The National Income Identity is a reflection of the fundamental principles of macroeconomics and the relationships between various economic agents in an economy.

Private Saving (Spvt): This represents the amount of income that households save after consumption. It indicates the level of resources that households retain for future consumption or investment.

Government Saving (Sgovt): This represents the difference between government revenue and government expenditure. If the government collects more revenue than it spends, it is running a surplus, which contributes to overall saving in the economy.

Current Account (CA): The current account reflects the country’s trade balance with the rest of the world. A positive CA implies that the country is exporting more goods and services than it’s importing, leading to a surplus in the current account. A negative CA indicates that the country is importing more than it’s exporting, resulting in a deficit.

Investment (I): Investment refers to spending on capital goods that enhance the productive capacity of the economy. It’s a key driver of economic growth and development.

The identity states that the sum of private saving, government saving, and the current account balance equals the amount of investment in the economy. In other words, it illustrates the relationship between the sources of funds available for investment and the uses of those funds. If the economy is running a trade surplus (positive CA), there are additional funds available for investment. On the other hand, if there is a trade deficit (negative CA), the economy may need to borrow from abroad to fund its investment.

Overall, the National Income Identity provides insights into the intricate connections between saving, government policies, trade, and investment in an economy. It’s a crucial tool for understanding the macroeconomic equilibrium and the factors that influence economic growth and stability.

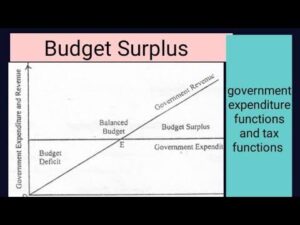

Q3. What is the budget surplus? Explain (Diagram is required).

Ans. A budget surplus occurs when a government’s total revenue exceeds its total expenditures during a specific period, typically a fiscal year. In other words, a budget surplus occurs when the government takes in more money through taxes and other revenue sources than it spends on its programs and services. A budget surplus is an indicator of a healthy fiscal situation and is often seen as a positive economic sign.

Here’s a simple diagram to explain a budget surplus:

In the diagram:

1. The vertical axis represents the amount of revenue and expenditure.

2. The horizontal axis represents time.

3. When the government’s revenue (taxes, fees, and other income) is greater than its expenditure (government spending on various programs, services, and debt servicing), a budget surplus occurs.

4. This situation is represented in the diagram as the gap between the revenue and expenditure lines.

Economic Implications:

A budget surplus has several economic implications:

1. Reduced Debt: A budget surplus allows the government to pay down its outstanding debt. This reduces the government’s interest payments and frees up resources for other uses.

2. Increased Savings: A surplus represents a net addition to the government’s savings, which can be used for future needs or emergencies.

3. Economic Stability: Budget surpluses contribute to economic stability by signaling that the government is managing its finances responsibly and is not relying heavily on borrowing.

4. Investment and Growth: The surplus funds can be allocated to investment in infrastructure, education, and other sectors that can stimulate economic growth and improve the quality of life for citizens.

5. Reduced Inflationary Pressures: If the government is running a surplus, it’s reducing its demand for resources in the economy, which can help moderate inflationary pressures.

It’s important to note that while a budget surplus is generally seen as positive, its appropriateness depends on the economic context. Sometimes, governments intentionally run deficits to stimulate economic activity during recessions. A balanced approach to fiscal management considers both short-term economic needs and long-term fiscal sustainability.

In summary, a budget surplus occurs when government revenue exceeds its expenditure. It has positive implications for reducing debt, increasing savings, and promoting economic stability and growth. However, the appropriateness of a surplus depends on the economic situation and policy goals.

Q4. What moves the economy toward equilibrium when the unintended inventory change is positive? And negative?

Ans. In macroeconomics, the concept of equilibrium refers to a situation where aggregate demand (total spending in the economy) is equal to aggregate supply (total production in the economy). Equilibrium is an important concept because it represents a stable point where there are no immediate pressures for change. When there is a disparity between aggregate demand and supply, the economy tends to move towards equilibrium.

Positive Unintended Inventory Change:

When the unintended inventory change is positive, it means that businesses have produced more goods than consumers are currently buying. This can happen when aggregate demand is lower than aggregate supply. In this situation, businesses find themselves with excess inventory, which they did not plan for.

To move the economy toward equilibrium:

Decreased Production: Businesses respond to the excess inventory by reducing their production. This decrease in production helps to bring the level of output more in line with the current level of consumer spending.

Layoffs and Reduced Income: As businesses cut back on production, they may need fewer workers. This leads to layoffs and reduced income for workers, which can further decrease consumer spending.

Lower Prices: Businesses may also lower their prices to encourage consumers to purchase the excess inventory. Lower prices can stimulate consumer demand and help reduce the inventory buildup.

As production decreases and demand increases due to lower prices, the economy moves closer to equilibrium where aggregate demand matches aggregate supply.

Negative Unintended Inventory Change:

When the unintended inventory change is negative, it means that businesses have produced fewer goods than consumers are currently buying. This situation arises when aggregate demand exceeds aggregate supply.

To move the economy toward equilibrium:

Increased Production: In response to the shortage of goods, businesses increase their production to meet consumer demand. This increase in production helps to reduce the gap between aggregate demand and supply.

Hiring and Increased Income: As businesses ramp up production, they may need more workers. This leads to hiring and increased income for workers, which can boost consumer spending.

Higher Prices: When there is excess demand, businesses may raise their prices due to scarcity. Higher prices can help to balance demand with supply by discouraging some consumers from purchasing or encouraging businesses to increase supply.

As production increases and demand is satisfied, the economy moves closer to equilibrium.

In both cases, the adjustment process continues until aggregate demand matches aggregate supply, leading to equilibrium. It’s important to note that the economy is dynamic and subject to various shocks and changes that can affect the equilibrium position. Economic policy, technological advancements, changes in consumer preferences, and external events also play a role in shaping the movement of the economy toward equilibrium.

Q5. The size of the multiplier varies directly with the size of the marginal propensity to consume. Do you agree with this statement? Explain.

Ans. Yes, I agree with the statement that the size of the multiplier varies directly with the size of the marginal propensity to consume (MPC). The multiplier effect is a fundamental concept in economics that illustrates how changes in autonomous spending can lead to larger changes in overall economic activity.

Multiplier Effect:

The multiplier effect refers to the magnification of an initial change in spending through the economy. It happens because an increase in spending creates income for the recipients of that spending, who in turn spend a portion of their income. This additional spending becomes income for others, leading to a chain reaction of increased economic activity.

Mathematically, the multiplier is calculated as:

Multiplier = 1 / (1 – MPC)

Where MPC is the marginal propensity to consume, representing the portion of each additional unit of income that households spend on consumption.

Explanation:

The relationship between the multiplier and the MPC can be understood by examining how changes in spending affect the economy:

Higher MPC: When the MPC is higher (consumers spend a larger portion of their income), it means that for every additional dollar earned, a larger portion is spent on consumption. This implies that a change in spending, whether positive or negative, will have a larger ripple effect throughout the economy. The higher the MPC, the more people will spend from the initial increase in spending, leading to a larger increase in total output.

Lower MPC: Conversely, when the MPC is lower (consumers save a larger portion of their income), a change in spending will have a smaller effect on total output. With a lower MPC, individuals are saving more of their income and spending less, which limits the expansionary impact of any initial increase in spending.

In simple terms, the higher the MPC, the more responsive households are to changes in their income, and the larger the multiplier effect. This is because a larger portion of any change in income is spent, creating a cascading effect on demand and economic activity.

Real-world Example:

Imagine an economy where the MPC is 0.8 (80%). This means that for every additional dollar earned, households spend 80 cents and save 20 cents. If the government increases spending by $100 million, households will spend 80% of that ($80 million) on consumption. As those businesses receive this additional $80 million, they will pay wages and buy supplies, leading to further rounds of spending and income creation.

In this case, the initial increase in government spending of $100 million leads to a total increase in output of $400 million ($100 million / (1 – 0.8)), illustrating the multiplier effect.

In summary, the size of the multiplier does indeed vary directly with the size of the marginal propensity to consume. A higher MPC leads to a larger multiplier effect, amplifying the impact of changes in spending on overall economic activity.

Q6. What are the determinants of exports and imports?

Ans. The determinants of exports and imports, also known as the factors influencing a country’s trade balance, are multifaceted and can be influenced by both domestic and international economic conditions. These determinants play a crucial role in shaping a country’s trade relationship with the rest of the world. Here are some key factors that influence exports and imports:

Determinants of Exports:

Price Competitiveness: The relative prices of a country’s goods and services compared to those of other countries can significantly impact its export competitiveness. A lower exchange rate can make a country’s exports more affordable for foreign buyers, boosting exports.

Quality and Innovation: The quality and technological innovation of a country’s products can enhance its global competitiveness. High-quality and innovative products can attract foreign consumers and drive export growth.

Global Demand: The level of demand for a country’s exports in international markets is a crucial determinant. If global demand for a specific product or industry is high, a country’s exports in that sector are likely to increase.

Trade Agreements: Participation in trade agreements and blocs can facilitate easier access to international markets, reducing trade barriers and increasing export opportunities.

Exchange Rates: Exchange rate fluctuations can impact the price of exports in foreign markets. A weaker domestic currency can make exports more competitive, while a stronger currency can have the opposite effect.

Domestic Production Capacity: A country’s ability to produce goods in sufficient quantities to meet foreign demand affects its export potential.

Government Policies: Export promotion policies, subsidies, tax incentives, and supportive infrastructure can influence a country’s export growth.

Determinants of Imports:

Domestic Demand: Strong domestic demand for certain goods and services that are not produced domestically can lead to higher imports.

Price Differences: If foreign goods are more competitively priced than domestically produced ones, consumers and businesses may choose to import those goods.

Consumer Preferences: Consumer preferences for foreign goods, such as luxury items or unique products, can drive imports.

Specialization: When a country specializes in producing certain goods and services, it may need to import others that it does not produce efficiently.

Raw Materials: Imports of raw materials and intermediate goods are essential for industries that rely on global supply chains.

Exchange Rates: Exchange rate fluctuations can impact the cost of imports. A weaker domestic currency can increase the cost of imported goods.

Trade Agreements: Access to imported goods can be influenced by trade agreements, tariffs, and non-tariff barriers.

Global Economic Conditions: Economic conditions in trading partners and globally can influence a country’s import demand.

Income Levels: As income levels rise, consumers may demand more imported goods, especially luxury items.

Population Growth: A growing population may lead to increased import demand for goods and services.

It’s important to note that these determinants are interconnected and can influence each other. Additionally, factors such as technological advancements, geopolitical events, environmental considerations, and changes in consumer preferences also play a role in shaping the trade dynamics of a country.

Q7. What is the relationship between bond price and the interest rate?

Ans. The relationship between bond prices and interest rates is inverse and is known as the bond priceinterest rate relationship, or simply the bond-price sensitivity. This relationship is a fundamental concept in finance and has significant implications for investors, bond markets, and the broader economy.

Inverse Relationship:

In general, when interest rates rise, bond prices fall, and when interest rates fall, bond prices rise. This inverse relationship is primarily due to the concept of opportunity cost and the way bonds are structured.

Opportunity Cost: When interest rates rise, newly issued bonds offer higher yields (interest payments) than existing bonds with lower yields. As a result, investors are more likely to prefer new bonds that offer higher returns. Consequently, the prices of existing bonds with lower yields decrease, making them less attractive in comparison.

Bond Structure: Bonds pay a fixed coupon (interest) rate to investors. When market interest rates rise, newly issued bonds offer higher coupon rates than older bonds with fixed lower coupon rates. This makes the older bonds less appealing, causing their prices to decrease.

Bond Price and Yield Relationship:

The relationship between bond prices and yields (or interest rates) can be understood by looking at how the yield of a bond is calculated:

Yield = (Coupon Payment + (Face Value – Current Price)) / Current Price

When interest rates rise, the yield on newly issued bonds increases, making them more attractive to investors. Consequently, the price of existing bonds must decrease to make their yields competitive with new bonds.

Duration: The sensitivity of bond prices to changes in interest rates is also influenced by a bond’s duration. Duration measures the weighted average time until a bond’s cash flows (coupon payments and principal repayment) are received. Bonds with longer durations are more sensitive to changes in interest rates. If interest rates rise, bonds with longer durations will experience larger price declines compared to bonds with shorter durations.

Implications:

The bond price-interest rate relationship has several important implications:

Investor Returns: Changes in interest rates can lead to capital gains or losses for bondholders. When interest rates decline, bond prices rise, generating capital gains for investors. Conversely, when interest rates rise, bond prices fall, leading to capital losses.

Bond Market Volatility: If interest rates are volatile, bond prices can experience significant fluctuations, affecting the overall bond market’s stability.

Bond Market Signals: Changes in bond prices can provide insights into market expectations about future interest rate movements. For example, falling bond prices may indicate expectations of rising interest rates.

Monetary Policy Impact: Central banks’ actions to raise or lower interest rates can impact bond prices and yields, influencing borrowing costs for governments, businesses, and consumers.

Yield Curve: The yield curve, which represents the relationship between bond yields and their respective maturities, can change shape based on shifts in short-term and long-term interest rates.

In summary, the inverse relationship between bond prices and interest rates is a critical concept for investors and policymakers to understand. Changes in interest rates can significantly impact the value of bond investments and have broader implications for financial markets and the economy as a whole.

SECTION-B

Q1. Explain the major macroeconomic issues.

Ans. Macroeconomic issues refer to significant challenges and concerns that impact an economy on a broad scale, affecting factors such as overall economic growth, employment, inflation, and the stability of financial markets. These issues are of paramount importance to policymakers, economists, and society as a whole. Here are some major macroeconomic issues:

Economic Growth: Economic growth refers to the increase in a country’s production of goods and services over time. Sustained and robust economic growth is essential for raising living standards, reducing poverty, and improving overall well-being. Issues related to economic growth include factors that promote or hinder it, such as investment, technological advancements, productivity, and government policies.

Unemployment: Unemployment occurs when individuals who are able and willing to work are unable to find employment. High levels of unemployment can lead to wasted human potential, lower consumer spending, and social unrest. Addressing unemployment is a key macroeconomic goal, and policymakers often use monetary and fiscal policies to promote job creation.

Inflation: Inflation is the persistent increase in the general price level of goods and services in an economy. Moderate inflation is generally considered normal, but hyperinflation or deflation (negative inflation) can have detrimental effects on economic stability. Central banks often use monetary policy tools to manage inflation and keep it within a target range.

Fiscal Policy: Fiscal policy refers to the use of government spending and taxation to influence the economy. Balancing government budgets, managing deficits, and determining the appropriate level of public expenditure are key fiscal policy challenges. A well-designed fiscal policy can support economic growth and stability.

Monetary Policy: Monetary policy involves the control of the money supply and interest rates by a central bank to achieve economic goals such as price stability and full employment. Deciding on the appropriate level of interest rates and managing the money supply to control inflation and promote growth are central challenges in monetary policy.

Income Inequality: Income inequality refers to the unequal distribution of income among individuals and households. Excessive income inequality can lead to social and political tensions, reduced social mobility, and economic inefficiency. Addressing income inequality is a major concern for policymakers aiming to ensure a fair and inclusive economy.

Trade Imbalances: Trade imbalances occur when a country’s imports exceed its exports or vice versa. Persistent trade deficits or surpluses can have implications for domestic industries, employment, and economic stability. These imbalances can also affect international relations and exchange rates.

Financial Stability: Maintaining a stable financial system is crucial for economic health. Issues such as banking crises, stock market volatility, and excessive risk-taking by financial institutions can have systemic consequences. Regulatory policies and oversight are aimed at ensuring financial stability.

Environmental Sustainability: Balancing economic growth with environmental sustainability is an increasingly important macroeconomic issue. Addressing concerns related to climate change, resource depletion, and pollution requires integrating environmental considerations into economic policies.

Global Economic Interdependence: In today’s interconnected world, macroeconomic issues often extend beyond national borders. Global economic integration raises challenges related to international trade, capital flows, and cooperation among nations to address common economic challenges.

Aging Population: Many developed economies are facing demographic challenges due to aging populations. This can strain social security systems, impact labor force participation rates, and require adjustments in policies related to retirement, healthcare, and pension systems.

These macroeconomic issues are interconnected and complex, requiring careful analysis and coordinated policy responses. Governments, central banks, international organizations, and economists continuously work to address these challenges and create conditions for sustainable economic growth, stability, and well-being.

Q2. Explain the steps involved in the estimation of GDP by income approach.

Ans. The estimation of Gross Domestic Product (GDP) through the income approach involves several sequential steps. Each of these steps is crucial in deriving an accurate and comprehensive measure of a nation’s economic output. Here’s a concise breakdown of the process:

1. Gather Income Categories: The first step is to categorize various sources of income generated within the economy. These categories typically include wages and salaries, profits, rents, interest, and taxes (minus subsidies).

2. Collect Data: Accurate and up-to-date data is crucial for the estimation process. Collect data from various sources, such as individual income tax returns, corporate financial statements, and national account statistics.

3. Calculate Gross Value Added (GVA): Gross Value Added is the difference between the value of output and intermediate consumption. It accounts for the value added at each stage of production. Sum up GVA across all sectors of the economy.

4. Determine Compensation of Employees: Calculate the total compensation of employees, including wages, salaries, and other benefits. This represents the income earned by labor.

5. Compute Gross Operating Surplus: Gross operating surplus is the income earned by capital owners in the form of profits, dividends, and interest. It reflects the income generated by production factors other than labor.

6. Calculate Gross Mixed Income: This includes income earned by self-employed individuals and unincorporated businesses. It’s a combination of labor income and capital income for these entities.

7. Calculate Taxes and Subsidies: Account for taxes on production and imports, minus subsidies. These adjustments provide a more accurate representation of the income generated.

8. Compute Net Income from Abroad: Consider net income earned from abroad, which includes net income from factors like foreign investments and remittances.

9. Derive GDP: The GDP is calculated by summing up the different income components: GDP = Compensation of Employees + Gross Operating Surplus + Gross Mixed Income + Taxes on Production and Imports – Subsidies + Net Income from Abroad.

10. Verify and Adjust: Cross-check the calculated GDP with other approaches (production and expenditure) to ensure consistency and accuracy. Make necessary adjustments if discrepancies are found.

11. Account for Depreciation: To derive Net Domestic Product (NDP), subtract depreciation from GDP. NDP provides a measure of the net output generated after accounting for the wear and tear of capital.

12. Presentation: Finally, organize the results in a clear and structured manner. Ensure that the data is easily comprehensible and follows the prescribed formatting guidelines.

By meticulously following these steps, economists and policymakers can accurately estimate the Gross Domestic Product using the income approach, providing valuable insights into the economic health and performance of a country.

Q3. Explain why the saving curve slopes upward and investment curve slopes downward in the saving-investment diagram. Give two examples of the changes that would shift the saving curve to the right.

Ans. In the saving-investment diagram, which represents the relationship between saving and investment in an economy, the saving curve slopes upward, and the investment curve slopes downward. This pattern reflects how saving and investment are affected by changes in the interest rate.

Saving Curve Sloping Upward:

The saving curve slopes upward because as the interest rate increases, the incentive for individuals and households to save more also increases. At higher interest rates, the opportunity cost of consuming today’s income becomes higher, encouraging people to save more for future consumption. This relationship is known as the income effect of a higher interest rate on saving. Additionally, higher interest rates can also mean higher returns on savings, which further incentivizes saving.

Investment Curve Sloping Downward:

The investment curve slopes downward because as the interest rate rises, the cost of borrowing for investment projects also increases. When interest rates are high, the cost of financing investment through loans or bonds becomes more expensive for firms. As a result, firms are less likely to undertake new investment projects, leading to a decrease in overall investment. This relationship is due to the fact that higher interest rates can reduce the profitability of investment projects and increase the burden of debt service.

Changes that Shift the Saving Curve to the Right:

Increase in Income: When people’s income increases, they tend to save a portion of the additional income. This can shift the saving curve to the right, indicating that at any given interest rate, people are willing to save more.

Changes in Consumer Confidence: If consumer confidence in the economy’s future prospects increases, people may become more inclined to save for future uncertainties. This can lead to an increase in the overall saving rate and a rightward shift of the saving curve.

Keep in mind that the shape and position of the saving and investment curves can also be influenced by other factors such as government policies, technological advancements, and changes in expectations.

Q4. The inclusion of taxes that flattens the aggregate demand curve and reduces the multiplier. Explain.

Ans. The concept you’re referring to is often associated with the multiplier effect and its impact on the aggregate demand curve. Let’s break down how the inclusion of taxes can flatten the aggregate demand curve and reduce the multiplier effect.

Multiplier Effect:

The multiplier effect is a concept in economics that explains how an initial change in spending can lead to a larger change in overall economic activity. It is based on the idea that an increase in spending (consumption, investment, government spending, etc.) leads to an increase in income for the recipients of that spending. These recipients, in turn, spend a portion of their increased income, which further boosts demand and income for others. This cycle continues, leading to a magnified impact on overall economic activity.

Aggregate Demand Curve:

The aggregate demand curve represents the relationship between the overall price level (price level) and the total quantity of goods and services demanded in an economy (real output or real GDP). It’s typically downward-sloping due to the wealth effect, interest rate effect, and foreign trade effect.

Inclusion of Taxes:

When taxes are included in the economy, they reduce households’ disposable income, which is the income available for consumption and saving after taxes are paid. This reduction in disposable income has a dampening effect on consumer spending. As a result, the initial increase in spending (which triggers the multiplier effect) is offset to some extent by the decrease in consumer spending due to taxes.

Effect on Aggregate Demand and Multiplier:

The inclusion of taxes reduces the marginal propensity to consume (MPC), which is the fraction of additional income that households spend. A lower MPC means that for every additional unit of income, households spend a smaller proportion, and save a larger proportion. This reduces the multiplier effect’s impact on increasing overall demand and income.

As a result:

1. The multiplier effect is weaker because the initial increase in spending generates a smaller increase in consumption due to the lower MPC.

2. The aggregate demand curve becomes flatter or less steep, indicating that changes in price level have a smaller impact on changes in real GDP.

In essence, the inclusion of taxes acts as a “leakage” in the multiplier process, reducing the overall effect of increased spending on the economy’s total output. This is why the aggregate demand curve becomes flatter and the multiplier effect is diminished when taxes are included.

Q5. What is the budget surplus? Explain why an increase in government purchases will reduce the budget surplus.

Ans. A budget surplus occurs when a government’s total revenues (such as taxes and other sources of income) exceed its total expenditures (such as government purchases and transfer payments). In other words, it’s a situation where the government is taking in more money than it’s spending during a specific period, usually a fiscal year.

When there is a budget surplus, the government has excess funds that it can use for various purposes, such as paying down debt, saving for future expenditures, or implementing tax cuts. A budget surplus is often seen as a positive economic indicator because it indicates that the government is managing its finances well and is in a position to save or invest.

Now, let’s address the second part of your question: Why would an increase in government purchases reduce the budget surplus?

When the government increases its purchases of goods and services (government spending), it is injecting more money into the economy. This increase in government spending directly contributes to aggregate demand, which is the total demand for goods and services in the economy.

However, government spending also has an impact on the government’s budget. An increase in government purchases leads to an increase in government expenditures. If the government’s expenditures exceed its revenues (taxes and other income sources), it can lead to a budget deficit. A budget deficit occurs when the government spends more than it collects in revenue.

In the context of your question, if the government increases its purchases without making corresponding adjustments to its revenue sources, it will likely result in a reduction in the budget surplus or the creation of a budget deficit if there was originally a surplus.

In summary:

1. An increase in government purchases leads to higher government expenditures.

2. If government expenditures exceed government revenues, it will reduce the budget surplus or lead to a budget deficit.

The key takeaway here is that changes in government spending can have direct implications for the government’s budget surplus or deficit, depending on whether the increased spending is funded by additional revenues or not.

Q6. Explain the money market equilibrium. Explain the mechanism of how a decrease in money supply affect the rate of interest in the money market.

Ans. Money Market Equilibrium:

The money market is where the demand for and supply of money interact, determining the equilibrium interest rate. In the money market, money supply represents the total quantity of money available in the economy, and money demand represents the amount of money that households and firms want to hold for transactions and as a store of value.

Money market equilibrium occurs when the quantity of money demanded equals the quantity of money supplied. This equilibrium interest rate is often referred to as the “equilibrium nominal interest rate.”

Mechanism of How a Decrease in Money Supply Affects the Rate of Interest:

Initial Condition: Initially, let’s assume the money market is in equilibrium, with the quantity of money demanded (MD) equal to the quantity of money supplied (MS), and the equilibrium interest rate (i) is determined.

Decrease in Money Supply: Now, if the central bank decides to decrease the money supply (MS), it can do so by selling government bonds or taking other measures to reduce the amount of money in circulation.

Excess Demand for Money: With the decrease in money supply, the quantity of money supplied (MS) becomes smaller than the quantity of money demanded (MD). This creates excess demand for money. In other words, there is not enough money available in the economy to satisfy the desired money holdings of households and firms.

Pressure on Interest Rates: As individuals and firms compete to obtain the limited available money, the demand for money exceeds the supply. This excess demand puts upward pressure on the interest rates. In other words, borrowers are willing to pay higher interest rates to access the limited money available.

Rise in Interest Rates: In response to the excess demand, the interest rates start to rise. Borrowers are willing to pay higher interest rates to secure loans, and lenders demand higher interest rates to lend out their limited funds.

Equilibrium Restored: As interest rates rise, the demand for money decreases while the supply of money increases (as people are less willing to hold money at higher interest rates). The interest rates will continue to rise until the point where the quantity of money demanded equals the decreased quantity of money supplied. This new equilibrium interest rate is higher than the initial equilibrium rate.

In summary, a decrease in money supply in the money market leads to an excess demand for money, which puts upward pressure on interest rates. As interest rates rise, the demand for money decreases, and the supply of money increases until a new equilibrium is reached at a higher interest rate. This mechanism highlights the inverse relationship between the money supply and the interest rate in the money market.

Q7. What is the high powered money? Explain the process ‘of credit creation by commercial banks.

Ans. High Powered Money:

High powered money, also known as monetary base or high-powered money supply, refers to the total amount of money that is directly controlled by the central bank of a country. It consists of two components: currency in circulation (physical currency held by the public) and reserves held by commercial banks in their accounts with the central bank. In essence, high powered money is the foundation upon which the entire money supply of an economy is built.

Process of Credit Creation by Commercial Banks:

Commercial banks play a crucial role in the process of credit creation, which expands the money supply beyond the initial high powered money provided by the central bank. This process is facilitated through the fractional reserve banking system. Here’s how credit creation by commercial banks works:

Initial Deposit: It all begins with an individual or business depositing money into a commercial bank. Let’s say the individual deposits $1,000 in cash.

Reserve Requirement: Central banks impose a reserve requirement on commercial banks, specifying the minimum fraction of deposits that banks must hold as reserves. Let’s assume the reserve requirement is 10%.

Reserve Creation: The bank is required to keep 10% of the deposited amount ($1,000) as reserves. This means that $100 will be kept in reserve, and the remaining $900 is considered excess reserves.

Loan Creation: The bank can lend out a portion of the excess reserves, creating a new loan. Let’s say the bank lends $800 to another individual.

New Deposit: The borrower who receives the loan, now having $800 in their account, has effectively created a new deposit in the banking system.

Repeat Process: The borrower might spend some of the borrowed money, which could end up in another bank. The receiving bank must also keep a fraction of the deposit as reserves and can lend out the remaining portion.

Multiplier Effect: This process can repeat several times as the money is deposited, lent, and re-deposited. As each new deposit is created, a portion is held in reserve while the rest is lent out, creating more deposits and further expanding the money supply.

Calculating the Money Multiplier:

The money multiplier is a measure of how much the money supply can expand from an initial change in high powered money. It’s calculated as the reciprocal of the reserve ratio (required reserve ratio):

Money Multiplier = 1 / Reserve Ratio

For example, if the reserve ratio is 10%, the money multiplier would be 1 / 0.10 = 10. This means that for every $1 of high powered money injected into the banking system, the money supply can potentially expand by up to $10.

It’s important to note that while the process of credit creation by commercial banks can expand the money supply, it is constrained by the reserve requirement and the willingness of borrowers to take out loans. The actual money supply expansion may be less than the potential indicated by the money multiplier due to various factors affecting borrowing and lending decisions.