Public Economics PYQ 2022

Read paper here or download the pdf file and share it with your mates

Q1. (a) How existence of the bureaucracy can lead to excessive growth of the public sector? Explain with the help of economic model.

Ans. The existence of a bureaucracy can indeed contribute to the excessive growth of the public sector. This phenomenon can be explained using the “bureaucratic expansion model,” which is a conceptual framework in public economics that highlights the incentives and behaviors that lead to the growth of government agencies and programs. Here’s how the model works:

Bureaucratic Expansion Model:

Bureaucratic Incentives: Bureaucracies are typically motivated to expand their scope and size. Bureaucrats may seek to justify their existence and secure larger budgets to enhance their influence and power within the government.

Budget Maximization: Bureaucracies often operate on a “use it or lose it” budgetary principle. If an agency does not spend its allocated budget in a given fiscal year, it might face budget cuts in the following year. This creates an incentive for agencies to spend their budgets, leading to the creation of new programs or the expansion of existing ones, even if the additional spending is not optimal.

Empire Building: Bureaucrats may engage in “empire building” by advocating for the creation of new programs or agencies under their control. The growth of their sphere of influence enhances their career prospects and organizational power.

Political Pressure: Bureaucrats may come under pressure from politicians and interest groups to provide additional services or benefits to constituents. This can lead to the expansion of the public sector to meet these demands.

Lack of Performance Evaluation: Bureaucracies might lack effective performance evaluation mechanisms. The focus on inputs (budget and staffing levels) rather than outputs or outcomes can result in a situation where the bureaucracy’s growth is not linked to its actual impact or efficiency.

Example:

Consider a fictional government agency responsible for environmental protection. Over time, this agency might experience bureaucratic expansion due to various factors:

a. The agency seeks to maximize its budget by suggesting the need for new environmental programs and initiatives, even if their effectiveness is uncertain.

b. To avoid budget cuts, the agency spends its entire budget each year, potentially leading to inefficient resource allocation.

c. Bureaucrats within the agency advocate for the creation of additional divisions or programs under the agency’s umbrella, expanding their influence and power.

d. Political pressure from environmental advocacy groups and citizens might lead the agency to take on more responsibilities, such as monitoring air quality in addition to its initial focus on water quality.

In this scenario, the agency’s growth is driven by bureaucratic incentives, budget dynamics, and political pressures. Over time, the public sector’s size and scope expand beyond what might be necessary or optimal, contributing to the excessive growth of government activities and spending.

It’s important to note that the bureaucratic expansion model presents a simplified explanation of complex interactions within government bureaucracies. The actual dynamics can be influenced by a range of factors including political considerations, external pressures, public demand for services, and institutional constraints.

(b) Define Externality. Show the inefficiency associated with positive externality with the help of suitable diagram.

Ans. Externality:

An externality is a concept in economics that refers to the impact of an economic activity on parties that are not directly involved in the activity. Externalities can be positive or negative, depending on whether the impact is beneficial or detrimental to third parties. Externalities occur when the actions of producers or consumers affect others who are not part of the transaction and whose interests are not taken into account in the market.

Inefficiency Associated with Positive Externality:

A positive externality occurs when the consumption or production of a good or service results in benefits for third parties beyond the direct buyers and sellers. In the case of a positive externality, the market tends to produce less than the socially optimal level of the good, leading to inefficiency.

Consider the example of education. Education generates positive externalities by enhancing an individual’s skills and knowledge, which in turn benefits society as a whole through increased productivity, innovation, and reduced crime rates. However, since these external benefits are not fully accounted for in the market, the market equilibrium quantity of education might be too low compared to the socially optimal quantity.

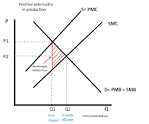

Diagram:

In the diagram below, we illustrate the inefficiency associated with a positive externality using the market for education as an example. The demand curve (D) represents the private benefit of education to individuals, while the supply curve (S) represents the cost of providing education. The social benefit curve (SB) reflects the total benefits of education, including both the private benefits and the positive externalities.

Positive Externality Diagram

In the absence of government intervention, the market equilibrium is at point E, where the supply curve (S) intersects the demand curve (D). At this equilibrium, the quantity of education is Q1, and the price paid by individuals is P1.

However, the socially optimal quantity of education is Q2, where the social benefit curve (SB) intersects the supply curve (S). At this quantity, the total benefits to society are maximized. The difference between Q2 and Q1 represents the under-provision of education in the market due to the positive externality.

As a result, there is an inefficiency associated with positive externalities. The market fails to account for the full societal benefits, leading to an under-allocation of resources to the production of the good. To address this inefficiency, government intervention, such as subsidies or public funding for education, can help align the market outcome with the socially optimal level of education.

Q2. (a) Show that optimal condition for the provision of public goods differ from private good in partial equilibrium analysis. Elaborate using the suitable diagrams.

Ans. The optimal conditions for the provision of public goods differ from those for private goods due to the presence of non-excludability and non-rivalry in consumption. In a partial equilibrium analysis, we can compare the provision of public goods and private goods by examining their demand and supply curves. Let’s elaborate using suitable diagrams:

Private Goods:

Private goods are excludable and rivalrous, meaning that individuals can be excluded from consuming them, and consumption by one individual reduces the amount available for others. The optimal provision of private goods is achieved where the marginal benefit (MB) equals the marginal cost (MC).

Private Goods Diagram

In the diagram above:

D represents the demand curve for a private good.

S represents the supply curve for the private good.

Equilibrium is at point E where MB equals MC. Quantity Q1 is produced and consumed at price P1.

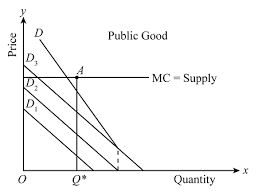

Public Goods:

Public goods are non-excludable and non-rivalrous, meaning that individuals cannot be excluded from their consumption, and consumption by one individual does not reduce availability for others. The optimal provision of public goods is achieved where the sum of individuals’ marginal benefits (MB1 + MB2 + …) equals the marginal cost (MC) of providing the good.

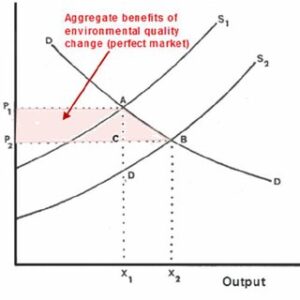

Public Goods Diagram

In the diagram above:

MB1, MB2, and MB3 represent the marginal benefits of individuals 1, 2, and 3.

S represents the supply curve for the public good.

Equilibrium is at point E where the sum of MB1, MB2, and MB3 equals MC. Quantity Q1 is provided and consumed, but this quantity is inefficiently low compared to what would be ideal for society (Q2).

Comparison:

For private goods, the equilibrium quantity is determined by the intersection of the demand and supply curves, ensuring that marginal benefit equals marginal cost.

For public goods, the optimal provision involves considering the aggregate marginal benefits of all individuals and equating this sum to the marginal cost. This leads to an outcome where the public good is underprovided compared to the socially optimal quantity.

In summary, the optimal conditions for the provision of public goods differ from private goods due to the non-excludability and non-rivalry associated with public goods. The absence of excludability and rivalry complicates the determination of equilibrium for public goods, requiring consideration of the total marginal benefits of all consumers rather than individual marginal benefits.

(b) If mobility is costless in local community context individuals would reveal their preferences, by moving to the locality that best reflected their tastes and offered the preferred tax benefit mix. Critically examine this statement.

Ans. The statement that “if mobility is costless in a local community context, individuals would reveal their preferences by moving to the locality that best reflected their tastes and offered the preferred tax benefit mix” is based on the idea of Tiebout sorting, a theory in public economics. While this theory offers insights into how local public goods and taxation might function in an idealized scenario, there are several limitations and critiques to consider. Let’s critically examine this statement:

1. Information and Rationality Assumptions:

The statement assumes that individuals have complete information about all the available localities, their tax structures, and the quality of public goods and services provided. It also assumes that individuals are rational decision-makers who prioritize their preferences accurately. In reality, people may not have perfect information, and their decisions can be influenced by factors beyond purely economic considerations.

2. Heterogeneity of Preferences:

While the Tiebout sorting theory assumes that individuals with similar preferences will cluster in the same locality, preferences are often multifaceted and complex. People’s preferences go beyond just tax benefits and public goods provision; factors like job opportunities, cultural amenities, family ties, and social networks also play a significant role in deciding where to live.

3. Mobility Costs and Constraints:

The assumption of “costless mobility” is problematic. Moving involves significant costs such as selling/buying property, changing schools for children, adapting to a new community, and potentially leaving behind job opportunities. These costs can deter people from relocating even if they find a locality more aligned with their preferences.

4. Equitable Access to Public Goods:

The Tiebout model assumes that individuals can sort themselves into localities based on their preferences, leading to an efficient provision of public goods. However, this model disregards equity concerns. If some individuals cannot afford to move, they might be excluded from accessing the localities that best suit their preferences, leading to unequal distribution of benefits.

5. Race to the Bottom:

In a competitive scenario where localities vie to attract residents, there might be a tendency for localities to reduce taxes and public goods provision to attract more individuals. This can lead to a “race to the bottom” where public goods are underprovided, particularly for marginalized communities that lack bargaining power.

6. Externalities and Spillover Effects:

Local public goods often have spillover effects that transcend local boundaries. For example, a well-educated workforce in one locality benefits neighboring areas as well. Tiebout’s model doesn’t adequately account for these externalities, and mobility decisions might not fully capture the broader societal impacts of public goods provision.

In conclusion, while the Tiebout sorting theory provides a useful framework for understanding the relationship between local public goods, taxation, and individual mobility, it oversimplifies the complexities of real-world decision-making. The assumptions of costless mobility, perfect information, and solely economic motivations do not align with the multifaceted realities of people’s lives. The model’s applicability depends on the extent to which these assumptions hold true in any given context.

Q3. (a) “If the market is allowed to function freely with complete information and zero transaction cost, the allocation of resources will be efficient and invariant with respect to legal rules of entitlement.” Do you agree or not? Explain.

Ans. The statement that “if the market is allowed to function freely with complete information and zero transaction costs, the allocation of resources will be efficient and invariant with respect to legal rules of entitlement” is rooted in the theory of perfect competition and the notion of Pareto efficiency. While this perspective has its merits, there are several important considerations and limitations that need to be taken into account. Let’s examine both sides of the argument:

Agree:

1. Pareto Efficiency: In a perfectly competitive market with complete information and no transaction costs, resources are allocated to maximize overall welfare, achieving Pareto efficiency. This means that no individual can be made better off without making someone else worse off.

2. Voluntary Exchange: When markets function freely, individuals engage in voluntary exchanges based on their preferences and needs. This leads to mutually beneficial transactions where both parties gain value.

3. Price as Information Signal: Prices in the market reflect the scarcity of resources and consumers’ willingness to pay. They act as information signals, guiding producers to allocate resources where demand is highest and creating an incentive for efficient production.

4. Efficient Resource Allocation: Competition drives producers to allocate resources efficiently, reducing wastage and ensuring that resources are directed to their most valued uses.

Disagree:

1. Market Failures: Free markets might not always lead to efficient outcomes due to market failures. Externalities (costs or benefits imposed on third parties), public goods, and natural monopolies are examples of cases where market allocation might be inefficient.

2. Incomplete Information: The assumption of complete information is unrealistic. In reality, information asymmetry can lead to situations where one party has more information than the other, potentially leading to suboptimal outcomes.

3. Transaction Costs: While the statement assumes zero transaction costs, in reality, transactions involve various costs like time, effort, and search costs. These costs can impede the efficiency of market exchanges.

4. Distributional Concerns: Efficient resource allocation might not necessarily lead to equitable outcomes. Markets can lead to income inequality and might not ensure that basic needs are met for all members of society.

5. Legal Rules of Entitlement: The statement assumes that legal rules of entitlement don’t affect efficiency. However, legal rules can have significant impacts on resource allocation, property rights, and incentives for economic activities.

6. Short-Term Focus: Markets can sometimes prioritize short-term gains over long-term sustainability. For instance, the overexploitation of common-pool resources like fisheries can lead to negative long-term consequences.

In conclusion, while the idea that free markets with complete information and zero transaction costs can lead to efficient resource allocation has theoretical validity, it’s important to acknowledge the limitations of this idealized perspective. Real-world markets often face complexities, externalities, and information asymmetries that can impede efficiency. Moreover, distributional concerns and the impact of legal rules cannot be ignored. A nuanced approach considers both the benefits and limitations of market mechanisms and the need for regulatory interventions when market failures occur.

(b) Does it matter whether the tax is levied on consumers or on producers; and levied specific tax or ad-valorem tax? Explain.

Ans. Yes, it does matter whether a tax is levied on consumers or on producers, as well as whether it is a specific tax or an ad-valorem tax. Each of these choices has distinct implications for the distribution of the tax burden, market outcomes, and economic efficiency. Let’s explore these factors:

1. Tax Incidence:

Tax on Consumers: When a tax is levied on consumers, the price paid by consumers increases, and producers receive the same price as before. The tax burden is shared between consumers (who pay higher prices) and producers (who receive lower prices).

Tax on Producers: When a tax is levied on producers, the price received by producers decreases, and consumers pay the same price as before. The tax burden is shared between producers (who receive lower prices) and consumers (who pay higher prices).

2. Market Outcomes:

Tax on Consumers: A tax on consumers decreases the quantity demanded in the market, leading to a reduction in both consumer surplus and producer surplus. The equilibrium quantity and price both decrease.

Tax on Producers: A tax on producers decreases the quantity supplied in the market, leading to similar reductions in consumer surplus and producer surplus. The equilibrium quantity and price both decrease.

3. Elasticity of Demand and Supply:

The impact of a tax on consumers or producers also depends on the elasticities of demand and supply. If demand is relatively inelastic compared to supply, consumers might bear a larger portion of the tax burden when it is levied on them. Conversely, if supply is relatively inelastic, producers might bear a larger portion of the tax burden when it is levied on them.

4. Specific Tax vs. Ad-Valorem Tax:

Specific Tax: A specific tax is a fixed amount of tax per unit of the good. It does not change with changes in price. Specific taxes tend to have a larger impact on the equilibrium quantity when demand or supply is more elastic.

Ad-Valorem Tax: An ad-valorem tax is a percentage of the price of the good. It increases with the price. Ad-valorem taxes have a larger impact on equilibrium price than on equilibrium quantity.

5. Economic Efficiency:

Both specific and ad-valorem taxes can distort market outcomes and lead to deadweight loss by reducing consumer and producer surplus. However, specific taxes can be less efficient in the presence of changing prices, as the tax amount does not adjust automatically with price changes.

In summary, the choice of whether to tax consumers or producers and whether to use a specific tax or an ad-valorem tax can significantly influence the distribution of the tax burden, market outcomes, and economic efficiency. The impact of these choices depends on factors such as the elasticities of demand and supply, the structure of the market, and the behavior of consumers and producers.

Q4. (a) Graduate student A smokes, but his office mate B hates smoking. A and B have the following utility functions: UA = 100 + 10z – 0.1z? and UB = 100 – 10z, where z is the number of cigarettes smoked by A (and UA includes the cost of cigarettes). Determine:

(i) The number of cigarettes smoked by A when the external effect on B is ignored.

(ii) The socially optimal level of cigarettes tha should be smoked by A.

(iii)The optimal Pigouvian tax needed to decentralize the social optimum.

(iv) The outcome with Coasian bargaining when the property right is assigned to the smoker.

(v) The outcome with Coasian bargaining when the property right is assigned to the nonsmoker.

Ans. (i) Number of cigarettes smoked by A when the external effect on B is ignored:

To find the number of cigarettes smoked by A when the external effect on B is ignored, we need to maximize A’s utility function, UA = 100 + 10z – 0.1z^2, with respect to z.

Taking the derivative of UA with respect to z and setting it equal to zero:

dUA/dz = 10 – 0.2z = 0

0.2z = 10

z = 50

So, when the external effect on B is ignored, A will smoke 50 cigarettes.

(ii) Socially optimal level of cigarettes smoked by A:

The socially optimal level of cigarettes smoked by A is determined by maximizing the sum of both A and B’s utility functions, subject to the constraint that their total utility is maximized.

Total Utility = UA + UB

Substituting the given utility functions:

Total Utility = (100 + 10z – 0.1z^2) + (100 – 10z)

Maximizing Total Utility with respect to z:

d(Total Utility)/dz = d(UA)/dz + d(UB)/dz = 10 – 0.2z – 10 = -0.2z

Setting this derivative equal to zero:

-0.2z = 0

z = 0

The socially optimal level is z = 0, meaning A should not smoke any cigarettes for maximum overall utility.

(iii) Optimal Pigouvian tax needed to decentralize the social optimum:

The optimal Pigouvian tax needed to internalize the external effect on B is equal to the difference between the private marginal cost and the socially optimal marginal cost.

Private Marginal Cost (MCp) = d(UA)/dz = 10 – 0.2z

Socially Optimal Marginal Cost (MCs) = d(Total Utility)/dz = -0.2z

Pigouvian Tax = MCp – MCs = (10 – 0.2z) – (-0.2z) = 10

(iv) Outcome with Coasian bargaining when the property right is assigned to the smoker:

When the property right is assigned to the smoker (A), A would try to maximize his utility while compensating B. B would accept compensation as long as it exceeds his loss in utility. The final outcome depends on their bargaining power and willingness to negotiate.

(v) Outcome with Coasian bargaining when the property right is assigned to the nonsmoker:

When the property right is assigned to the nonsmoker (B), B would try to maximize his utility while compensating A. A would accept compensation as long as it exceeds his loss in utility. Again, the final outcome depends on their bargaining power and willingness to negotiate.

(b) Examine the approach to the classification on impure public goods focuses on the mix of services that stem from the provision of the good.

Ans. The classification of goods as impure public goods introduces an interesting nuance to the traditional categorization of public goods. Impure public goods, also known as mixed goods, exhibit characteristics of both public goods and private goods. The approach to classifying impure public goods focuses on the mix of services that result from the provision of the good. This approach takes into account the degree of rivalry and excludability present in the consumption of the good, as well as the potential for selective provision.

Here are the main features of the approach to classifying impure public goods:

1. Rivalry and Excludability Spectrum:

Impure public goods lie on a spectrum between pure public goods and pure private goods. At one extreme, a good can exhibit more public good characteristics, such as non-rivalry and non-excludability. At the other extreme, a good can have more private good characteristics, such as rivalry and excludability.

2. Mix of Services:

The classification of impure public goods focuses on the mix of services that the good provides. This includes both the non-excludable benefits that resemble public goods and the excludable benefits that resemble private goods.

3. Selective Provision:

Impure public goods can be selectively provided, meaning that some individuals can receive the benefits while others do not. This contrasts with pure public goods where benefits are universally available once provided.

4. Examples:

Healthcare: Healthcare services can exhibit characteristics of an impure public good. Basic medical information and health improvements (e.g., reduction in contagious diseases) might have some non-excludable and non-rivalrous features. However, advanced medical treatments can be excludable and rivalrous.

Education: Education can be classified as an impure public good. Basic knowledge and social benefits of education may have public good elements, while specialized education and personalized training can be more rivalrous and excludable.

5. Policy Implications:

The classification of goods as impure public goods highlights the need for nuanced policy approaches. Governments might need to consider how to selectively provide certain aspects of the good while ensuring that critical public benefits are not neglected.

In conclusion, the approach to the classification of impure public goods recognizes the complexity of goods that exhibit mixed characteristics of both public and private goods. By focusing on the mix of services provided and the degree of rivalry and excludability, this approach allows for a more flexible understanding of goods’ characteristics and better informs policy decisions related to their provision.

Q5. (a) What is the rationale for intergovernmental transfers in India? Elaborate the key recommendations of fifteenth finance commission for horizontal and vertical devolution between centre and state; and among the states

Ans. Rationale for Intergovernmental Transfers in India:

Intergovernmental transfers in India are financial arrangements between the central government and state governments that aim to ensure fiscal stability, promote balanced regional development, and empower states to provide essential public services. The rationale for these transfers is rooted in several factors:

1. Fiscal Imbalance: Different states in India have varying levels of revenue-generating capacity and expenditure requirements. Intergovernmental transfers help bridge fiscal gaps and ensure that states can provide essential services to their populations.

2. Resource Mobilization: States have different levels of resource endowments and economic activities. Transfers help states with lower revenue bases to have adequate resources to meet their development needs.

3. Equalization: Transfers promote fiscal equalization by redistributing resources from prosperous states to less-developed states, thereby reducing inter-state economic disparities.

4. Decentralization: Intergovernmental transfers contribute to decentralization of power and resources, enabling states to take responsibility for service delivery and governance.

5. Fiscal Autonomy: Intergovernmental transfers enhance the fiscal autonomy of state governments by providing them with additional funds without being overly dependent on their own revenue sources.

Key Recommendations of the Fifteenth Finance Commission:

The Fifteenth Finance Commission (FFC) was constituted by the Government of India to recommend the distribution of funds between the central and state governments for the period 2021-2026. The FFC’s recommendations include horizontal devolution (among states) and vertical devolution (between the Centre and states). Here are the key recommendations:

Horizontal Devolution:

The FFC adopted the following criteria for horizontal devolution:

Income Distance: States with lower per capita income were given higher shares to promote equity.

Population: The share of states in the devolution was assigned based on their population size.

Area: To account for the fiscal needs of larger states with more administrative responsibilities.

Demographic Performance: States with a lower fertility rate were rewarded for demographic achievements.

Forest Cover: Given the need to conserve forests, states with larger forest cover received higher shares.

Tax Effort: States’ efforts to generate revenue through their own taxes were recognized and rewarded.

Vertical Devolution:

The FFC recommended vertical devolution as 41% of the divisible pool of central government tax revenues. This is a slight increase from the previous commission’s recommendation of 42%. This ensures that a significant portion of central taxes is allocated to states, giving them fiscal space for development activities.

Performance Grants:

The FFC introduced a new category of performance grants to incentivize states for specific areas, including health, education, agriculture, and water management.

Local Governments:

The FFC recommended that 4.31% of the divisible pool be allocated to local governments, including panchayats and municipalities.

Conclusion:

The recommendations of the Fifteenth Finance Commission reflect an attempt to balance fiscal needs, promote equity, and incentivize states to achieve specific developmental goals. The horizontal and vertical devolution mechanisms are designed to distribute resources in a manner that reflects the principles of cooperative federalism and encourages balanced development across the states of India.

(b) Suppose government impose tax on interest on saving and after tax saving remain unchanged, would this imply tax is non- distortionary? Explain.

Ans. No, the fact that after-tax savings remain unchanged does not necessarily imply that the tax is non-distortionary. Taxation can have various effects on economic behavior, and the impact of a tax on savings depends on several factors, including the elasticity of saving, individual preferences, and the structure of the economy.

Distortionary vs. Non-Distortionary Taxes:

A non-distortionary tax is one that does not alter individuals’ economic behavior, meaning it does not lead to changes in consumption, savings, work effort, or investment decisions. It has no impact on the allocation of resources in the economy.

A distortionary tax, on the other hand, alters economic behavior and leads to inefficiencies in resource allocation. It can discourage certain activities and lead to changes in consumption, savings, or investment that do not align with individuals’ preferences.

Impact on Savings:

In the context of a tax on interest income from savings, if after-tax savings remain unchanged, it could imply that the tax is not causing a significant distortion in saving behavior. However, this does not automatically make the tax non-distortionary. Several factors need to be considered:

Elasticity of Savings: The elasticity of savings is crucial. If individuals are highly sensitive to changes in after-tax returns on savings (i.e., they have high elasticity), even a small change in after-tax returns could significantly alter saving behavior.

Substitution and Income Effects: Changes in after-tax returns can result in both substitution effects (altering the relative attractiveness of saving versus consumption) and income effects (affecting overall income and, hence, consumption and saving decisions).

Portfolio Choices: Individuals’ portfolio choices might be affected. For instance, they could shift from taxable savings to tax-exempt assets or alter investment decisions to minimize the tax impact.

Time Horizon: Short-term versus long-term effects matter. In the short term, individuals might not adjust their savings behavior, but over the long term, they might respond differently.

Overall, several factors determine whether a tax on interest income is distortionary or not. The impact on saving behavior should be assessed over a reasonable time frame, and the responsiveness of individuals to changes in after-tax returns should be considered. While unchanged after-tax savings may suggest a relatively lower level of distortion compared to a scenario with significant changes, it does not automatically classify the tax as non-distortionary. The complexity of economic decision-making and behavioral responses must be taken into account when evaluating the distortionary effects of taxation.

Q6. (a) In case of two-goods (Labor and Consumption good x) economy with a single consumer and single producer, show how the optimal commodity tax is determined.

Ans. In a two-goods economy with a single consumer and single producer, the optimal commodity tax is determined by considering the trade-off between maximizing consumer satisfaction (utility) and producer profits. The consumer’s utility is derived from consuming the consumption good (x), while the producer’s profit is influenced by the producer’s cost of producing the consumption good.

Let’s break down the steps to determine the optimal commodity tax:

1. Consumer’s Utility Function:

The consumer’s utility function represents their preferences for consuming the consumption good (x) and providing labor. It can be denoted as U(x, L), where U represents utility, x is the quantity of the consumption good, and L is the amount of labor supplied.

2. Producer’s Cost Function:

The producer’s cost function represents the cost of producing the consumption good (x) using labor. It can be denoted as C(x, L), where C represents cost, x is the quantity of the consumption good, and L is the amount of labor used.

3. Maximization of Consumer Utility:

The consumer aims to maximize their utility subject to their budget constraint. The budget constraint is based on the income earned from supplying labor and the price of the consumption good. Mathematically, the problem can be stated as:

Maximize U(x, L) subject to px = wL

where p is the price of the consumption good, w is the wage rate, and px is the expenditure on consumption.

4. Profit Maximization by the Producer:

The producer aims to maximize their profit by choosing the optimal quantity of the consumption good (x) to produce. Mathematically, the problem can be stated as:

Maximize π = px – C(x, L)

where π represents profit.

5. Equilibrium Condition:

In an optimal situation, the quantity of the consumption good (x) and the amount of labor (L) chosen by the consumer and the producer respectively should satisfy the equilibrium condition, which means that the consumer’s marginal utility of consuming an additional unit of x is equal to the producer’s marginal cost of producing that unit. Mathematically:

MU(x)/p = MC(x)

Here, MU(x) represents the marginal utility of consuming x, and MC(x) represents the marginal cost of producing x.

6. Optimal Commodity Tax:

The optimal commodity tax can be determined by adjusting the price of the consumption good (p) such that the equilibrium condition is satisfied. The tax can be calculated as:

Tax = p_optimal – p_original

The optimal tax would be the difference between the adjusted price (p_optimal) and the original price (p_original) that ensures equilibrium between consumer utility and producer profits.

In summary, the optimal commodity tax in a two-goods economy with a single consumer and single producer is determined by considering the equilibrium condition that balances consumer utility and producer profits. The tax adjusts the price of the consumption good to achieve this equilibrium.

(b) What makes sound tax system? What ails the Indian tax system elaborated by M. Govinda Rao?

Ans. What Makes a Sound Tax System:

A sound tax system is one that effectively raises revenue for the government while minimizing distortions in economic behavior, promoting equity, and fostering economic growth. A well-designed tax system is characterized by several key principles:

1. Efficiency: Taxes should minimize distortions in economic decisions, ensuring that individuals and businesses make choices based on their preferences rather than to avoid taxes.

2. Equity: Taxes should be fair and distributed according to the ability to pay. Progressive taxation, where higher income individuals pay a higher proportion of their income in taxes, is often considered equitable.

3. Simplicity: A simple tax system reduces compliance costs for taxpayers and administrative costs for the government. Complexity can lead to loopholes and tax evasion.

4. Transparency: The tax system should be transparent and easily understandable by taxpayers. This helps build trust in the system and encourages compliance.

5. Stability and Predictability: Frequent changes to tax laws can disrupt economic planning and create uncertainty. A stable and predictable tax environment is beneficial for both taxpayers and the economy.

6. Administrative Efficiency: The tax administration should be efficient and effective in collecting revenues and enforcing tax laws.

7. Neutral: Taxes should not favor one type of economic activity over another. A neutral tax system treats similar economic activities similarly, regardless of their form.

8. Revenue Sufficiency: The tax system should generate sufficient revenue to fund government expenditures while maintaining fiscal sustainability.

Ails of the Indian Tax System Elaborated by M. Govinda Rao:

M. Govinda Rao, an Indian economist and taxation expert, has highlighted several issues with the Indian tax system. Some of the key concerns include:

1. Complexity: The Indian tax system is known for its complexity, with multiple layers of taxes (central and state) and numerous exemptions and deductions. This complexity increases compliance costs for taxpayers and administrative challenges.

2. High Tax Rates: High tax rates, especially on income and corporate profits, can discourage investment and economic growth. Rao emphasizes the need to rationalize tax rates to improve economic efficiency.

3. Lack of Transparency: The presence of numerous exemptions and incentives creates opacity in the tax system, allowing for tax evasion and avoidance.

4. Inefficiency: The tax system is not always efficient in terms of resource allocation. Certain industries and economic activities may receive preferential treatment, distorting market outcomes.

5. Tax Evasion: Tax evasion remains a significant challenge in India due to weak enforcement mechanisms and opportunities for non-compliance.

6. GST Implementation Challenges: The Goods and Services Tax (GST) implementation faced initial challenges, including technological issues, multiple tax rates, and compliance complexities.

7. Intergovernmental Relations: The division of tax revenue between the central and state governments can lead to conflicts and challenges in fiscal federalism.

8. Informal Economy: A large informal sector in India leads to a smaller tax base and limits the effectiveness of tax collection efforts.

In conclusion, a sound tax system is essential for promoting economic growth, equity, and efficient resource allocation. M. Govinda Rao’s elaboration on the ails of the Indian tax system highlights the need for reforms to simplify, rationalize, and make the tax system more transparent, efficient, and conducive to economic development.

Q7. (a) Briefly discuss the silent features of Goods and Service tax (GST) in India. What are the anomalies associated with GST?

Ans. Silent Features of Goods and Services Tax (GST) in India:

Goods and Services Tax (GST) is a comprehensive indirect tax system introduced in India on July 1, 2017, aimed at replacing a complex web of existing indirect taxes like excise, VAT, and service tax. The GST framework aims to streamline the tax structure, eliminate cascading effects, and create a unified market across the country. The silent features of GST in India include:

1. Single Tax Regime: GST replaces multiple indirect taxes with a single tax, simplifying the tax structure and reducing compliance burden.

2. Dual GST Model: GST in India follows a dual model, with both central and state components. Central GST (CGST) is levied by the central government, and State GST (SGST) is levied by the state governments.

3. Destination-Based Tax: GST is a destination-based tax, meaning the tax revenue is collected by the state where the goods or services are consumed, ensuring that the taxing jurisdiction benefits from economic activities within its borders.

4. Input Tax Credit: GST allows businesses to claim input tax credit (ITC) for taxes paid on inputs and services used in the production process. This helps avoid the cascading effect of taxes and promotes efficiency.

5. Comprehensive Coverage: GST covers the entire supply chain, from raw materials to the final consumer. It includes goods and services, both tangible and intangible.

6. Threshold Limits: Small businesses with an annual turnover below a specified threshold are exempted from GST registration, reducing compliance burden for micro and small enterprises.

7. Technology Driven: GST is largely technology-driven, with an online portal for registration, return filing, and payment of taxes. This digitization aims to improve transparency and reduce administrative complexities.

8. Uniform Tax Rates: GST introduces uniform tax rates across states and products, simplifying tax calculations and reducing market distortions.

9. Anti-Profiteering Mechanism: To prevent businesses from unjustly profiteering due to reduced taxes, an anti-profiteering mechanism is in place to ensure that the benefits of reduced taxes are passed on to consumers.

Anomalies Associated with GST:

1. While GST aimed to simplify and streamline the tax system, there are several anomalies and challenges that have arisen:

2. Multiple Tax Rates: The multiplicity of tax rates, including standard, reduced, and special rates for different goods and services, has led to classification challenges and disputes regarding the correct tax rate for certain products.

3. Complex Compliance: Despite digitization efforts, GST compliance can still be complex due to the requirement for multiple monthly returns and intricate procedures.

4. Inverted Duty Structure: Some industries face an issue of “inverted duty structure,” where the tax rate on inputs is higher than the tax rate on the final product. This leads to accumulation of input tax credit.

5. Exemptions and Special Cases: Exemptions and special provisions for certain products and sectors can lead to classification challenges and potential misuse.

6. GST Network (GSTN) Issues: Technical glitches and outages on the GSTN portal have caused compliance challenges for taxpayers.

7. Tax Evasion and Fraud: Despite efforts to reduce tax evasion, some instances of fraudulent input tax credit claims and tax evasion have been reported.

8. Interstate Transactions: Compliance and procedural challenges persist in interstate transactions, particularly for small businesses that may not have a physical presence in the consuming state.

9. State Variation: Despite the aim of creating a unified market, there are still variations in procedures, interpretations, and administrative practices among states.

In conclusion, while GST has brought significant reform to India’s indirect tax system, challenges and anomalies persist. Addressing these issues requires continuous dialogue, improvements in the technology infrastructure, and policy adjustments to ensure the effective implementation and benefits of the GST regime.

(b) What factors govern the auditing and punishment decision for tax evasion by individuals in the economy? Discuss the role of government in this context.

Ans. The auditing and punishment decision for tax evasion by individuals in an economy is influenced by a combination of economic, legal, and administrative factors. The government plays a pivotal role in determining the strategy for detecting tax evasion, conducting audits, and imposing penalties. Here are the key factors that govern these decisions:

1. Magnitude of Tax Evasion:

The extent to which an individual evades taxes can influence the government’s response. High levels of tax evasion may lead to more rigorous enforcement efforts.

2. Detection Costs:

The costs associated with detecting tax evasion, including administrative costs and the expenses of conducting audits, influence the likelihood of audits. Higher detection costs may lead to fewer audits.

3. Penalties and Deterrence:

The severity of penalties for tax evasion affects individuals’ behavior. Strong deterrents, such as high fines and criminal charges, can discourage tax evasion.

4. Risk Preferences:

Individuals’ risk preferences play a role in their decisions to evade taxes. Some individuals might be more risk-averse and less likely to evade taxes if the potential penalties are significant.

5. Administrative Capacity:

The government’s ability to effectively conduct audits and investigations depends on its administrative capacity, including the availability of skilled personnel and technological infrastructure.

6. Tax Policy and Compliance Culture:

The complexity of tax laws and regulations can impact tax evasion rates. Simplified tax codes and clear guidelines can foster a compliance culture.

7. Probability of Detection:

The perceived probability of getting caught influences individuals’ decisions to evade taxes. A higher probability of detection can act as a deterrent.

8. Political and Social Considerations:

Government policies can be influenced by political and social factors. Striking a balance between ensuring compliance and avoiding excessive enforcement is essential.

Role of Government:

The government plays a significant role in combating tax evasion and promoting tax compliance. Here’s how:

1. Enforcement Strategies: Governments determine their enforcement strategies, including the allocation of resources for audits, investigations, and technological tools for data analysis.

2. Auditing Selection: Government agencies select taxpayers for audits based on risk assessment, using various algorithms and data analytics to identify suspicious patterns.

3. Audit Process: Government auditors conduct examinations to verify the accuracy of taxpayers’ reported information. Audits can be random or targeted based on risk assessment.

4. Penalty Imposition: Governments impose penalties and fines on individuals found guilty of tax evasion. The severity of penalties serves as a deterrent.

5. Public Awareness and Education: Governments play a role in educating taxpayers about their tax obligations, the consequences of evasion, and the benefits of compliance.

6. Legal Framework: Governments establish the legal framework for prosecuting tax evaders, defining the criteria for criminal charges and penalties.

7. International Cooperation: In cases of cross-border tax evasion, governments may collaborate with other nations to share information and pursue offenders.

In conclusion, the auditing and punishment decisions for tax evasion are influenced by a combination of economic factors, legal considerations, administrative capacity, and the government’s approach to enforcement. A well-balanced approach involves implementing effective enforcement strategies, maintaining fairness, and fostering a culture of voluntary compliance through education and awareness.